The DC 37 Health & Security Plan instituted its generic-based prescription drug program two decades ago in response to the skyrocketing costs of prescription drugs.

Today, about 80 percent of the prescriptions covered by the plan are for generics. Over the years, as members have become more comfortable about using generic drugs, the greater usage of generics has helped the plan save millions of dollars.

Still, with 20 percent of the prescriptions covering brand-name drugs, there is room for improvement.

Despite the plan’s steps to control costs, drugs continue to eat up a growing portion of money that funds all of the plan’s benefits, which include education, counseling, vision, legal, podiatry, and dental services. Some members are under the mistaken belief that their dues fund their benefits. That is not true: the employer funds the benefits.

Searching for savings

Currently, the city contributes $1,790 annually per member and retiree for the union-provided benefits of covered individuals. This single contribution funds all the benefits for the entire family. Because that contribution is no longer enough to cover the cost of the benefits, the plan has been forced to dip into its cash reserve. Administrators fear the reserve could be exhausted by 2018 if cost-savings measures are not adopted.

As drug costs continue to consume a growing portion of its budget, the DC 37 Health & Security Plan is searching for savings. The plan is currently conducting requests for proposals (“RFP”) for the prescription benefit managers of both the members’ benefit (OptumRx) and the retirees’ Medicare Part D benefit (UnitedHealthcare) with the hope of obtaining some price concessions. Additionally, as part of a campaign to address this financial pressure, the plan is encouraging more members and retirees to use generic drugs.

“Most members are using generic medication whenever possible, but a lot of members continue to rely on brand-name drugs,” said Willie Chang, administrator of the DC 37 Health & Security Plan. “A greater use of generics by members and retirees is one of the steps that can help us control costs.”

The members’ generic-based plan requires them to pay more out of pocket to use brand-name drugs if there is a generic that can be taken.

Generics: safe and effective

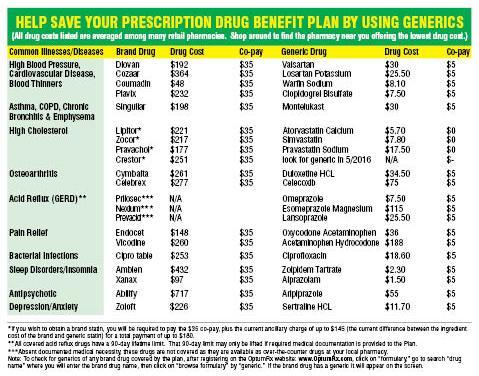

The plan has a three-tier structure that provides a financial incentive for using generics. You are charged a $5 co-pay for generics, $15 for a preferred brand-name drugs and $35 for non-preferred brand-name drugs. If you don’t want to use a generic, your physician must document your medical need for a brand-name drug.

If you simply choose to take a brand drug when a generic is available, you are charged the highest co-pay for using a brand-name drug. In addition to meeting the higher brand co-pay, you must pay the difference between the ingredient cost of the brand-name drug and that of the generic equivalent — which can be a hefty sum of money.

“Some members continue to prefer brand-name drugs, but there is really little reason to worry about the safety and effectiveness of generics,” said Audrey Browne, the plan’s associate administrator and counsel.

Years ago, patients used to be disinclined to use generics because of their concern over the safety of the drugs and whether the medications really are as effective as brand-name drugs. That view has evolved as employer and union drug plans and the federal government educated people about generics.

Before generics are put on the market, they must be approved by the federal Food and Drug Administration. The approval means that the FDA has determined a generic drug is comparable to its brand-name counterpart in dosage, performance, safety, quality and strength.

A “generic equivalent” drug has the same active ingredients as its brand-name counterpart. Most states have laws that allow pharmacists to replace brand-name drugs with generics.

Generics generally cost 30 to 80 percent less than brand-name drugs, which save consumers and the health industry more than $100 billion every year. Unfortunately, the profit-seeking pharmaceutical industry has started to push up the prices of some generics.

At age 65, DC 37 retirees are covered by a Medicare Part D drug plan, which isn’t a generic-based program. Therefore, they can use brand drugs that have generic equivalents without having to pay the same ancillary fee that active members pay.

Retirees too can pay lower co-pays and help the plan save the money it spends on covering the higher cost brand drugs by asking their physicians about using a generic alternative.

Another way for everyone to save is to compare the drug prices of the pharmacies in your area. You may do that by going to the website of the plan’s administrator at http://www.optumrx.com.